#ThinkSabio Latest News

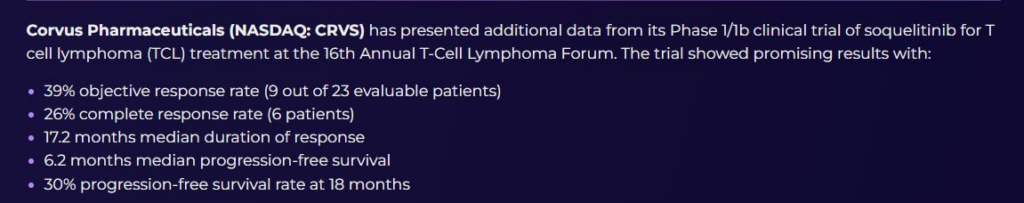

Corvus Pharmaceuticals Announces Presentation of Additional Data from the Phase 1/1b Clinical Trial of Soquelitinib for Patients with T Cell Lymphoma

Yes, overall this data is quite promising, especially for an early-stage Phase 1/1b trial in a difficult-to-treat cancer like T-cell lymphoma (TCL). Here’s why: 1. Strong Efficacy Signals • 39% Objective Response Rate is above average compared to existing treatments. • 26% Complete Response Rate is exceptionally strong — complete responses in early-phase trials often indicate deep drug activity. • 17.2 months median duration of response is very impressive — this shows that patients who respond are staying in remission for a long time. 2. Competitive Edge • Compared to other approved TCL treatments (Pralatrexate, Romidepsin, etc.), soquelitinib shows better or comparable efficacy with potentially better durability. • If follow-up studies confirm this performance, soquelitinib could be a best-in-class or strong second-line therapy. 3. Long-Term Benefit • The 30% PFS rate at 18 months indicates a subset of patients achieving long-term benefit, which is rare and valuable in oncology trials. 4. Potential Catalysts • These results can attract larger partners, move toward Phase 2/3, and unlock significant upside for CRVS if the trend continues. Bottom Line (Analyst View): • Yes, it’s promising — the early efficacy, especially CR rate and DoR, are better than most approved drugs in this space. • The trial now needs to be followed up with larger, randomized studies to confirm these benefits and establish safety across broader patient groups. • For investors, this marks a positive inflection point, and CRVS could see upward valuation momentum if development progresses well.

calculating the Total Addressable Market (TAM) for soquelitinib in T-cell lymphoma (TCL) gives us a clearer picture of its commercial potential and the upside for CRVS investors. 1. T-Cell Lymphoma Market Overview: • T-cell lymphomas (TCL) are rare and aggressive blood cancers, accounting for: • ~10–15% of all non-Hodgkin’s lymphomas (NHL) • Estimated global incidence: ~30,000–35,000 new cases/year • U.S. incidence: ~6,000–7,000 new cases/year • Subtype focus: Peripheral T-cell lymphoma (PTCL) and Cutaneous T-cell lymphoma (CTCL) are most common 2. Market Size Estimates: Region Annual Patients (Est.) Est. Annual Spend per Patient TAM Estimate United States ~6,500 patients ~$150,000–$200,000 (drug pricing, infusion, diagnostics, follow-up) $1.0 – $1.3 billion/year Global Market ~30,000–35,000 patients ~$80,000–$150,000 (varies by region) $3.0 – $5.0 billion/year Note: These estimates include drug pricing (based on comparable therapies), infusion/administration, diagnostics, and hospital care costs. 3. Commercial Takeaways: • Even a modest market penetration (10–20%) in the U.S. alone can yield $100–$250 million annually for soquelitinib. • With orphan drug designation, premium pricing, and limited competition, Corvus could realistically achieve high per-patient revenue. • If soquelitinib is expanded into other T-cell lymphoma subtypes or used in combination therapies, TAM could grow significantly. 4. CRVS Upside Potential (Hypothetical Valuation Impact) • If soquelitinib is approved and captures just 15% of global TCL market, that’s $450M–$750M annual revenue potential. • Applying a 5x revenue multiple (standard for biotech with oncology assets) → $2.25B–$3.75B valuation opportunity vs current CRVS market cap (under $200M as of recent levels). • That’s a 10x–15x upside potential if everything aligns (regulatory approval, market access, commercial rollout).